The New Retirement Plan Save Almost Everything, Spend Virtually Nothing WSJ

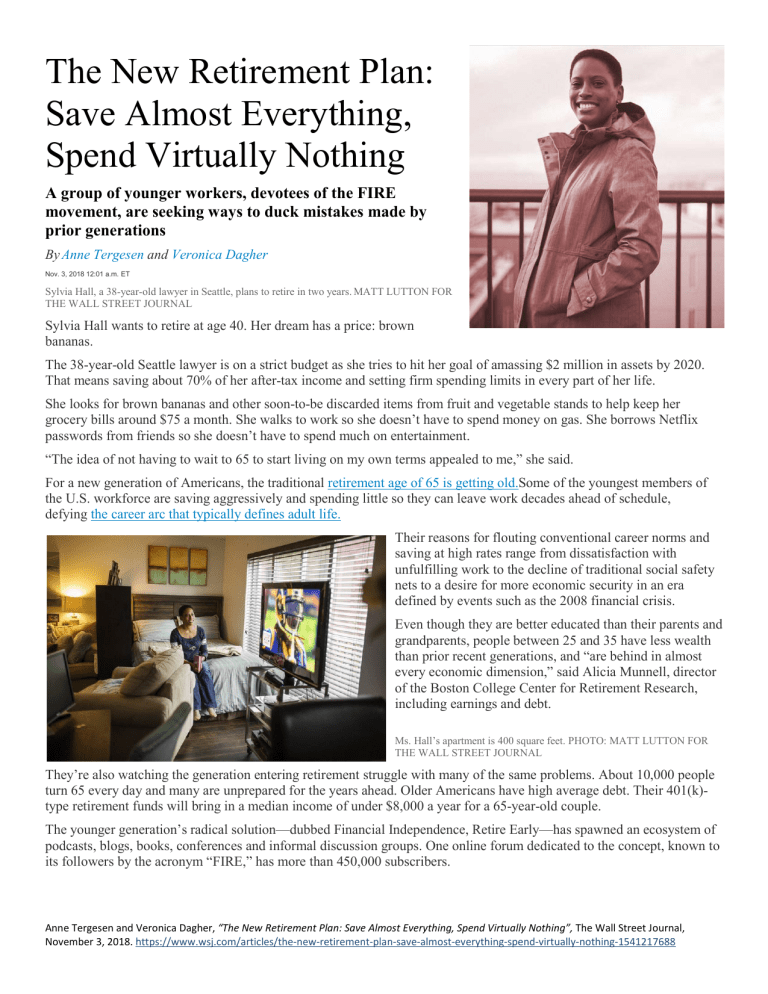

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing A group of younger workers, devotees of the FIRE movement, are seeking ways to duck mistakes made by prior generations.

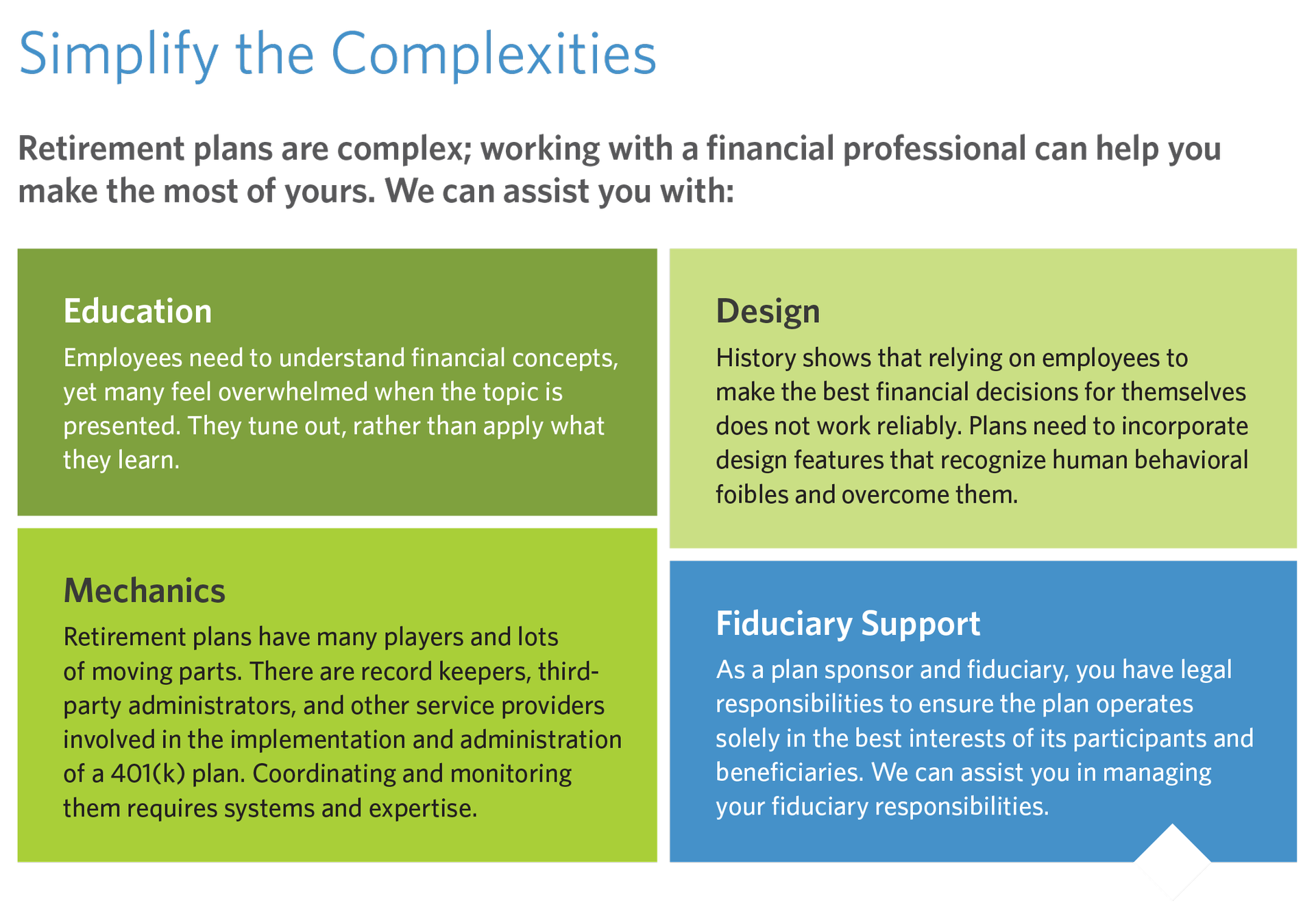

Retirement Plans D. Eggers III, M.Ed., AIF®,CRPC® CPFA®

Getty When it comes to retirement planning, Americans are often way behind. In fact, in 2019, almost half of households headed by someone 55 or older had no retirement savings at all,.

The New Retirement Plan Save Almost Everything, Spend Virtually Nothing (GotBitcoin?) YouTube

A self made financially independent individual is someone who went against general trends in society for a decent length of time, who now suddenly has essentially infinite free time (e.g. probably 10 times the amount of a salaried worker or more, normalizing for energy levels).

Working with a Financial Counselor to Plan Your Retirement

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing by: Anne Tergesen; Veronica Dagher Some of the youngest members of the U.S. workforce are saving aggressively and spending little so they can leave work decades ahead of schedule.

Retirement Savings Plans for Expats Smash your Goals!

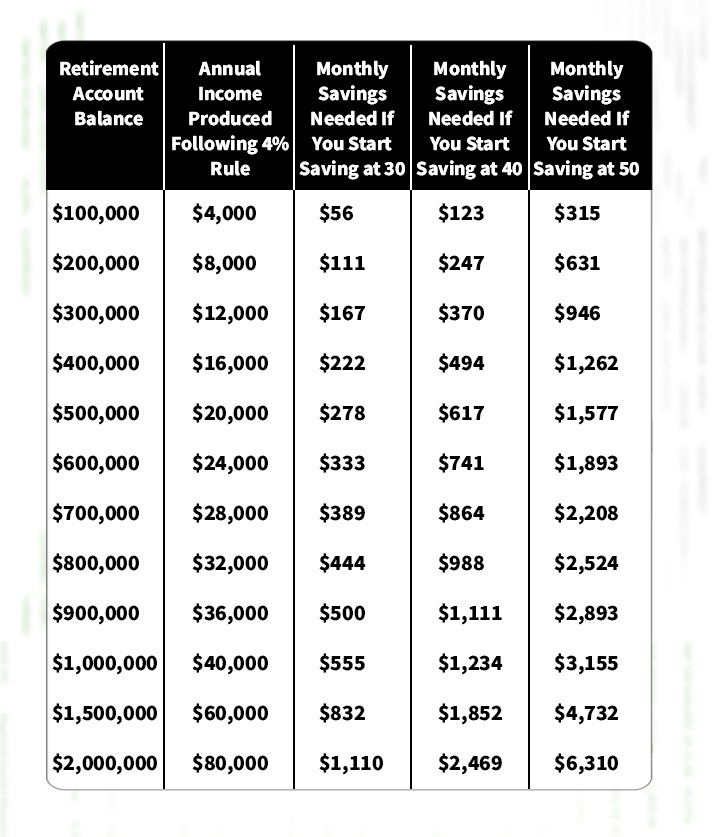

1. Figure out how much you need to save It's tough to get where you're going if you don't know where you're at, so step one is figuring out what you already have and what you need. Record the.

How to Save For Retirement Planning Kids Off The Block

39.5%. 2024. 2026. It may not be possible to set aside a huge chunk of your earnings, so start small and set up automatic transfers from your paycheck or bank account. Even funneling as little as.

Retirement is the new retirement plan InvestmentNews

Defined contribution plans: These are now the most common type of workplace retirement plan. Employers set up these plans, such as 401(k)s and 403(b)s, to enable employees to contribute to an.

IRS Announces 2022 Limits for Retirement Plans

The federal spending package unveiled on Tuesday includes new provisions that would alter how millions of Americans save for retirement, including older people who want to stash away extra.

The Everything Retirement Planning Book eBook by Judith B Harrington, Stanley J. Steinberg

A recent Wall Street Journal piece titled "The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing" has generated almost 1,000 comments.

Developing a Realizable Vision for Retirement Lifetime Paradigm

Center for Retirement Research at Boston College, based on data from the Survey of Consumer Finances (amount of senior household debt); Employee Benefit Research Institute estimates (percentage.

6 Article The New Retirement Plan Save Almost Everything, Spend Virtually Nothing WSJ (1)

The legislation, known as Secure 2.0 (a follow-up to the Secure Act of 2019), has significant new rules for saving for retirement, withdrawing money from retirement plans, dealing with financial.

Rebuild your retirement savings

Three to five years before retirement, if time allows, treat this window as a dress rehearsal. For example, if volunteering is important, join one or two organizations in advance to ensure that.

Retirement calculator How much you need to save Canada News Group

A group of younger workers, devotees the the FIRE movement, are seeking trails to leave the workplace decades ahead of the norm, ducked mistakes made the previous generations. One woman's grocery total is so extensive she knows how much yours will pay all month for oatmeal: five pounds for $3.

I Have A Retirement Plan I Plan On Traveling SVG Cut File Etsy

Open a health savings account (HSA) If you don't have access to a 401 (k), Bakkum suggests maximizing other company benefits. A health savings account (HSA) lets you put pre-taxed funds aside.

Ms. Hall’s apartment is 400 square feet. Work Family, Grocery Budgeting, Retirement Planning

The SECURE Act 2.0, enacted in late 2022, changed more than 90 rules about IRAs and other qualified retirement plans. The changes are phased in over several years. Here are some key changes.

Retirement Plans D. Eggers III, M.Ed., AIF®,CRPC® CPFA®

Here are its key characteristics. 1) A single plan. AWRP's investment options would resemble those of the federal government's Thrift Savings Plan. It would contain 1) a government bond fund,.